With 91% of U.S. taxpayers e-filing more than 128 million federal returns in 2015, and almost 8 out of 10 businesses e-filing federal returns — an increase of 9% in the last year — citizens have come to expect online filing and payment options as the norm. Yet, many local governments haven’t made the switch to offering online options, or they have outdated online processes. Today, we are pleased to announce the launch of Accela Business Tax, the latest addition to our Finance and Administration solution for local governments.

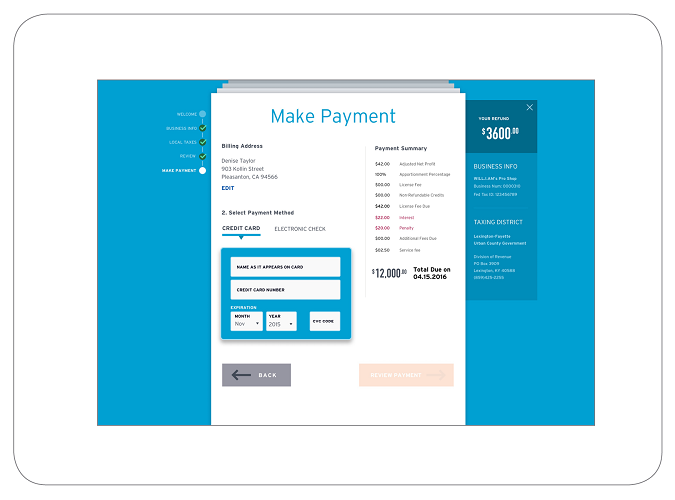

Accela Business Tax drastically improves outdated tax management processes, increases productivity across government agencies and brings the complexities of local business tax filings and payments to an easy-to-navigate online portal, giving cities and counties within certain states a customizable solution for tax filing and management. This new product provides a digital solution with an intuitive user experience, bringing a previously cumbersome process online.

With Business Tax, local governments can now offer their constituents:

1. Convenience

At Accela, we are on a mission to provide digital solutions that bring processes online and make them more convenient for citizens. Taxes are already taxing, so we have lifted the stress of filing and paying in person (because who really has time for that?).

With Business Tax, taxpayers can now file and pay from anywhere with payment options including credit card, debit card and e-check — even at the last minute.

With all of these payment options available online, you no longer have to take valuable customer service time to provide this option over the phone or in person. So not only are online payments convenient for businesses, but they also make your staff more efficient. Agency staff has less paperwork to handle, reduced storage costs and fewer people in line. As we like to say at Accela, “the goal is to get customers out of line and put them online.”

2. Connectivity

While workflows don’t sound exciting, incorporating online options may cause some to jump for joy because they make life so much easier. For instance, your taxpayers will probably be quite happy to be walked through a series of questions to help them complete their necessary forms — all while skipping irrelevant questions — resulting in less reading and fewer mistakes.

Once their forms are complete, the system creates a link so they can track the return for greater transparency and ease of mind. No more paperwork black holes. Additionally, tax returns and supporting documentation are automatically updated and attached to the return transaction record, for quick and easy retrieval.

In addition to the convenience of connectivity, going digital also means the elimination of huge stacks of paper. No longer do taxpayers need to print and mail in a packet of supporting information — now they can simply upload the documentation to their return filing. Not only that, but by moving the process online, you can eliminate extra storage hassles and the high costs associated with maintaining paper records.

Each of these items is great on its own, but even better is the sum of the parts — you are able to get money in the bank faster through online returns and payment processing!

3. Efficiency

Your taxpayers will be excited about filing and paying online, but you may be more excited about the ability to automate tracking and year-end reconciliation processes because of the savings in time and frustration. Automating detailed reconciliation tracking helps you minimize the time-consuming work typically performed manually for your monthly, quarterly and year-end reconciliation processes.

Modernizing and streamlining traditionally cumbersome return processes frees up staff time, speeds processes and reduces human error. Not only that, it is easy to identify delinquent filers and track them down to ensure you receive timely payments.

And to make communication easier, you can also mass-process communications, saving your staff significant time. Quickly generate letters such as delinquent filings, infractions and general communications to multiple taxpayers, instead of sending individual communications.

4. Flexibility

Last but not least, Accela Business Tax is also very flexible — it can handle varying rates and schedules, such as monthly, quarterly and annual filings and payments, as well as varying types of taxes, including net profit, gross receipts, transient room, hotel and motel, sales, franchise, occupational and payroll.

You also have a lot of flexibility with the creation of configurable forms — all tax forms and documentation can be customized to each city, county or state to capture the specific information required.

Find out more

Business Tax is currently available for local government agencies in Kentucky, Washington, Illinois, Alabama, Colorado, California and Pennsylvania. You can find out more about the product on our website, or contact us to schedule a demo.